I don’t know about you, but when tax season comes around, I tend to put off doing my taxes for as long as possible. Not only are they taxes, but taxes for travel nurses is a whole other and more complicated ball game.

I want to add that I am in no way a professional tax accountant, and everything written here is of my own opinions and experiences. Please consult a professional tax preparer when doing your taxes.

So tell me, when tax season rolls around, do you find yourself feeling more lost than trying to insert a Foley catheter on an 80-year-old woman?

Well don’t worry — I got you.

I’m here to help you tackle the unique tax considerations that come with the territory of being a travel nurse.

Key Takeaways

- Maintain a Tax Home: This is crucial for accessing non-taxed stipends and benefits.

- Document Everything: Keep detailed records of all work-related expenses and income.

- Understand Multi-State Taxation: Be prepared to file returns in each state you work in, and understand how to avoid double taxation.

- Maximize Deductions: Familiarize yourself with which expenses are deductible to reduce your taxable income.

- Seek Professional Help: Considering the complexity of taxes for travel nurses, utilizing professional tax services can help ensure accuracy and compliance.

Understanding Taxes For Travel Nurses

Decoding Your Tax Home

Understanding your tax home is essential for travel nurses when it comes to filing income taxes.

Your tax home is your permanent home — what you use as your “permanent address”.

As a travel nurse working all over the country, you may not “live” at your permanent tax home, but you still need to maintain a tax home to comply with the IRS and state tax rules. This means that even though you do not live at a permanent home in a specific state, you must establish and maintain a tax home in the eyes of the IRS.

For many travel nurses, this can be confusing, especially if you have travel nurse housing provided or if you receive tax-free stipends during your assignments.

One key aspect of claiming a tax home is that you must pay rent every month, at the very least. You need to be able to show that you pay money to maintain this home. This can be proven by rental (or mortgage) payments. You can also pay for the home’s utilities and home improvements, but be sure to keep a record of these transactions in case you get audited.

Overall, it is crucial for travel nurses to understand the concept of a tax home and how it affects their tax situation. By maintaining your tax home, you can ensure you are compliant with IRS rules and take advantage of the tax deductions available to us.

Now, just so we’re all on the same page, here’s a quick rundown of what a tax home consists of:

- Permanent Address: Where you live when you aren’t traveling. All of your important mail is sent here, you may have this address listed on your driver’s license, your car is registered here, and you are registered to vote here.

- Frequent Visits: It is important to return home for at least 30 days during the year. If not, it can be said that you have “abandoned” your permanent home and it will not count as your tax home to the IRS1.

- Maintain Strong Ties: You have a vested interest here, whether through rent payments or property ownership. You have paid money to keep this home and to keep it in good shape.

Whether you work as a travel nurse full-time or part-time, knowing how to navigate travel nurse pay and travel expenses is essential when it comes to that dreaded time of the year.

State Taxes

Tax considerations for travel nurses are an important aspect of working in the healthcare industry, especially for those working in multiple states.

When you work as a travel nurse, your tax situation can become complicated. You may need to pay taxes to the state you work in, as well as your home state.

To avoid a hefty tax bill, travel nurses must be proactive in their tax preparation efforts. This includes hiring a certified tax professional familiar with the unique tax considerations that apply to travel nurses and allied healthcare professionals.

Working in different states means paying non-resident state taxes. On top of this, we are also having our home state taxes taken out at the same time. To help offset some of the tax burden associated with working in multiple states, claiming tax deductions and credits specific to travel nursing can help (more on this below).

Finally, you also need to pay state income taxes to your home state. This is where you would file your state income tax return and declare your income earned as a travel nurse. Travel nurses remain tax residents of their home state, liable for paying state income tax on all earned income. Without a permanent tax home, you may be subject to a new tax situation where you may need to pay state income taxes in multiple states where you have worked as a travel nurse.

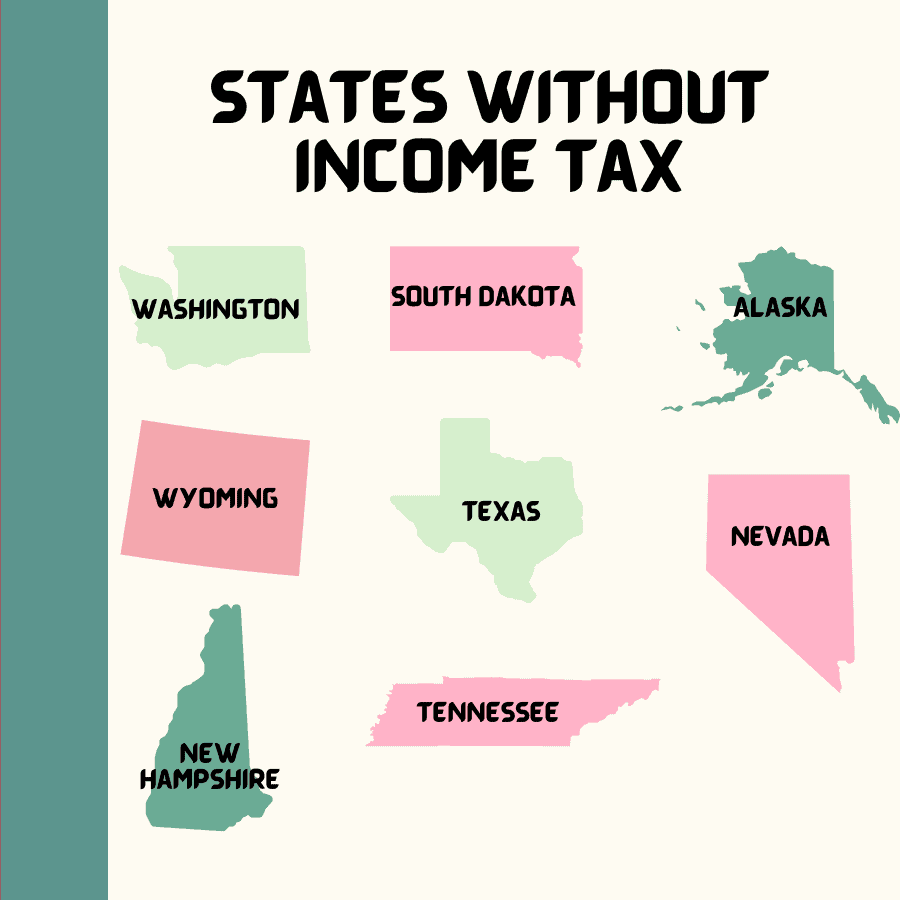

On your pay stub, you should see income taxes taken out for the state you are currently working in, as well as your home state (unless you work in Washington or any of the other 8 states that do not have income taxes).

The One-Year Rule

If a travel nurse stays at one assignment for more than 12 months in a 24-month period, then this place could be seen as the new tax home in the IRS’s eyes.

This isn’t the exact rule, the actual rule is very complicated with many different considerations and exemptions, but it is a general rule that we travel nurses follow.

There are a few things to know about this:

- The 12 months do not have to be consecutive. This means in sum (for example if you worked January – May and then August – February, it’s still over 365 days in a 24-month period).

- If you are in one place for 12 months, this means you didn’t go back to your tax home for a whole year, which means you abandoned your tax home and it no longer qualifies.

- Try to go home for at least 30 days.

- If you do work more than a year (in a 2-year period) then the IRS will think you now live in this new place and you will no longer receive your stipends tax-free — they will now be taxed2.

If you do find a hospital that you absolutely love working at, then maybe it’s time to consider coming on there as staff. Or maybe you relocate there and keep the job as PRN. Or, you take a year away and come back at a later time. Either way, the point is that we have options, and that is one of my favorite things about this career.

Read How To Become A Travel Nurse.

Deductions and Write-Offs

One way to help offset this double taxation situation is to take advantage of tax write-offs.

Travel nurses have access to a variety of deductions and write-offs. From uniforms and licensing fees to ongoing education and travel costs – there are a surprisingly large amount of options that are allowed. Effectively utilizing these write-offs necessitates maintaining precise records.

But don’t worry, it’s not as complicated as it sounds.

What I recommend (and do myself) is two things: one, have one credit card that you put all things travel nursing on. I’m talking about scrubs, meals, gas, everything — as long you purchased it in the city in which you are currently working, it counts.

The second thing I recommend is to get the QuickBooks app — especially if you are in a situation where you drive home on your days off. That’s a lot of potential miles to deduct and gasoline to be reimbursed for. The app not only tracks your mileage, but you can also connect your bank accounts so it automatically pulls your “work expenses” over and you have everything in one place.

Something important to remember: if your agency is reimbursing you for anything (scrubs, licenses, relocation) then you are not legally allowed to write it off on your taxes since you have already been reimbursed.

Common Tax Deductions

Since travel nurses already receive tax-free stipends and reimbursements from our agencies, a lot of potential deductions will already have been accounted for. But, just in case your agency doesn’t do reimbursements, here is a list of things that you will want to keep the receipts for and present to your accountant. Even if they can’t use all of it, it can’t hurt to try.

Common Mistakes To Avoid

When preparing taxes for travel nurses, it’s important to steer clear of some avoidable mistakes.

One of the biggest mistakes is not keeping thorough and organized records of work assignments and expenses. This can lead to missed deductions or even potential tax audits.

Another mistake is not understanding the tax home and non-resident tax obligations. It is important to determine if you have a tax home or if you are considered to not have a tax home, as this will affect how you need to file your tax return.

Finally, not seeking tax advice from a professional can lead to errors in your tax filing. It is recommended to always consult a tax professional who is familiar with the complexities of travel nursing to help navigate the process and make tax preparation easier.

Here are some other common mistakes to avoid:

- Treating all states the same

- Forgetting to track professional expenses

- Not keeping records and copies of everything

- Mixing personal and professional travel expenses

- Ignoring the need for a professional tax guide

Resources for Tax Assistance

Before you decide that this is all just too much, know that plenty of resources are tailored specifically for travel nurses. From specialized tax professionals to software that can handle multi-state filings, help is just a search away.

A great place to start is TravelNurseTax.com — they specialize in doing taxes for us travel nurses. Click this link to check them out.

And remember, your fellow travel nurses are always a great source of advice and support – after all, who understands your struggles better than someone who’s been there?

Conclusion

Taxes for travel nurses can come off as scary and intimidating, but with the tools and organization, it’s really not that bad.

As long as you’re maintaining a tax home, not staying in one place for too long, and keeping a decent record of your spending then you should be okay when the time does come to file. And I know I said it about a million times, but I highly encourage you to seek out a tax professional.

It is also super important to hire someone who has experience with traveling professionals since we aren’t just dealing with one state’s laws.

Have any tax tips or hilarious tax mishap stories? Drop them in the comments below.

And if you are looking for more tips, read my post “21 Travel Nurse Tips” for some of my best advice.

If you found this article helpful, I would love for you to share it!

FAQ

Are travel nurses taxed differently?

Sure, travel nurses might face different tax situations compared to permanent staff nurses because of how their work and pay are set up. Travel nurses typically get a good chunk of their pay as non-taxed stipends for travel, housing, and meals. We also tend to work in multiple states, making filing for state taxes much more complicated.

How can travel nurses save on taxes?

Travel nurses can save on taxes through several methods:

1. Maintaining a Tax Home

2. Tracking Work-Related Expenses

3. Utilizing Retirement Accounts

4. Education Deductions

It’s crucial to keep detailed records of all your expenses, assignments, and contracts throughout the year to keep track of your deductions and non-taxable income.

What is the 1-year rule for travel nurses?

The 1-year rule is an IRS guideline affecting travel nurses’ tax home status and stipends. If a travel nurse works in one area for more than 12 months in a 24-month period, it could become their new tax home, making previously non-taxed stipends taxable.

Disclaimer: I may earn commissions from purchases made through the links in this post at no extra cost to you.

![Decoding Taxes for Travel Nurses: How To Avoid Hidden Tax Traps [In 2024]](https://ashlyjean.com/wp-content/uploads/2024/02/Taxes-For-Travel-Nurses.png)